The Emerging Fintech Sector in the Philippines

3/5/2020 | By Marella Gimenez

The Philippines, possessing a mostly young, tech-savvy populace and a fast-growing economy, is preparing itself for other emerging sectors popping up in the local digital landscape. With over 30.4 million people owning smartphones and new government investment in data science, the country has cultivated a conducive environment for developing new technology and innovations.

Financial technology, a rising industry that utilizes technology and other digital means for financial activities, has seen a boom recently in the Philippines. The country’s government agencies – like the Bangko Sentral ng Pilipinas (BSP), Department of Trade and Industry (DTI), and the Securities and Exchange Commission (SEC)– have been fervently supportive about the bullish growth of fintech innovation and the financial sector’s digitalization. The BSP, in particular, have been pushing its initiatives aimed at financial digitization for some time now to accelerate inclusive growth, the progress of the overall economy, and in making the country more globally competitive.

A Hotbed For Fintech

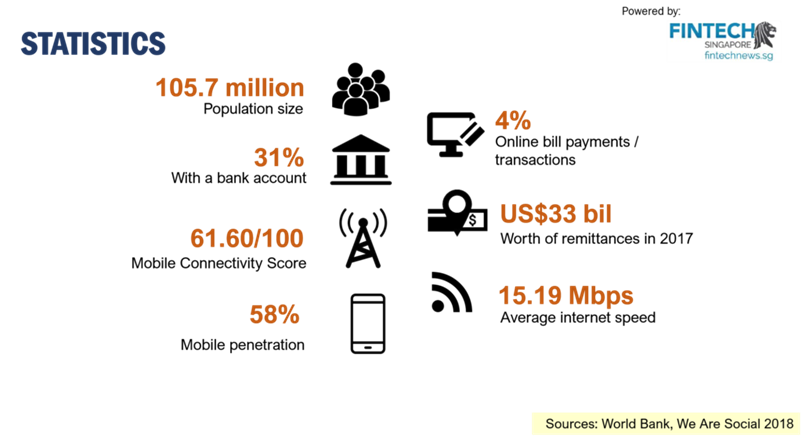

The Philippines has a population of over a 100 million people, with 71% being active internet users and a majority of them having mobile subscriptions. With the internet penetration rate of the country at 73%, this makes it a suitable breeding ground for the latest technology to be introduced and tested.

The e-money system has recently seen a rise in users ever since its debut in the country, now having 20 million registered users and over 63,000 partner merchants that accept e-money payments. This overtakes the total number of credit card holders and has made transactions more convenient for Filipinos. The way the digital wallet works is by making transactions possible through the use of smartphone apps that have digital payment schemes.

The successful establishment of an e-money wallet is because of BSP’s adoption of what it calls a “sandbox” learning environment. This pertains to fintech innovators being permitted to operate on a test or pilot basis while a regulator closely monitors their activity. Critical strengths and weaknesses are then identified to be able to draft a regulatory framework that the e-money system could operate on. With financial technology, BSP has been able to execute the perfect balance of digitalization with minimal risk in financial dealings and have encouraged innovators to bring new technology into the country at a time when there were no similar systems in place yet.

Fintech Making the Philippines More Globally Competitive

The adoption of financial technology in the country has boosted their ratings in the Global Fintech Index for 2020, with a score of 8.831 that improves their standing to the 46th place which has climbed up 8 notches. In terms of cities, Manila was also noted as one of the top 3 Southeast Asian cities for its viability in fintech business and transactions across the Asia-Pacific region.

Building a cashless ecosystem would also result in improving the Philippines’ standing in the Global Competitiveness Index of the World Economic Forum (WEF). This ecosystem plays a key role in supporting the digital economy’s development throughout several industries and presents opportunities and advantages for the economy overall. According to McKinsey Global Institute, digital finance could potentially raise gross domestic products of emerging economies, like the Philippines, by as much as 6% in 2025.

By adopting fintech solutions, the country’s business landscape is able to provide consumers and companies with better, seamless processes that result in productivity and economic growth. Consumers are no longer burdened with a paper-based system and businesses are more likely to succeed because of the ease of doing financial activities through technology.

On the Right Track

Despite fintech’s many benefits, there are still some doubts and precautions to be made due to the opaqueness of its operations. Unlike brick-and-mortar banks, digital banking uses third party intermediaries and linkages which open up new risks for the financial system.

Nevertheless, this hasn’t stopped companies and startups from investing and utilizing the new technology, with the fintech’s transaction value predicted to grow at an annual rate of 16.4% to reach $10.5 million dollars by 2022. The Philippine startup economy is also still young and full of potential, giving it plenty of room to grow and bridge gaps in business services, in tech and financial inclusion. With a thriving business landscape and accessible tech solutions, other foreign companies looking to invest in the country will have better ease in setting up their business. The country’s vast talent pool also makes it perfect for building their own remote team that’s based locally.

BSP’s initiative in promoting financial technology is to additionally support financial inclusion, making it easier for disadvantaged communities to get access to financial tools and services. Promoting inclusivity helps drive economic expansion as there are more people engaging in commerce and trade.

The government plans to further develop this technology by launching similar cases and platforms for this in the near future, to drive economic growth in both a macro and micro level that can be sustained in the long run.