The Real Cost of Traditional Office Lease: A Financial Planning Guide for Growing Companies

By Ailysh Velarde | 04/14/2025

Signing a traditional office lease in the Philippines has long been seen as a milestone—an investment in permanence, credibility, and a long-term vision. Especially in key business districts like BGC, Makati, and Ortigas, securing office space has often symbolized growth and maturity.

But today’s business landscape looks different. Startups scale fast. Teams evolve. And agility is often more valuable than square footage. In this environment, understanding the true financial impact of office space—beyond monthly rent—is critical for business leaders planning their next move.

This guide breaks down the real costs behind traditional leases, helps you weigh them against flexible workspace models, and gives you a clearer view of what makes the most sense for your growth stage and financial strategy.

What Is a Traditional Office Lease?

A traditional office lease typically involves a long-term agreement—usually 3 to 7 years—for a commercial space that’s rented as a “bare shell” (unfurnished and unfinished). These are common in Metro Manila’s prime business zones and come with a number of cost components that businesses need to account for.

Here’s what that usually includes:

- Unfurnished, “bare shell” space: The space is delivered as-is, often with minimal interior work. Your team is responsible for all renovations and design.

- Tenant fit-out: Construction, furniture, branding, and layout customization fall on you.

- Self-managed services: Utilities, internet, cleaning, maintenance, and security must be sourced and managed independently.

- Long lease terms: Breaking the lease early can come with fees or forfeiture of security deposits.

These aren’t necessarily downsides—they’re investments. But like any investment, they come with risk. And for companies still testing markets, scaling quickly, or managing cash carefully, these upfront and ongoing commitments require serious financial planning.

What Are the Real Costs of a Traditional Office Lease?

When planning for office space, it's easy to focus on the monthly rent—but the total cost of leasing a traditional office goes far deeper. For growing companies, especially those expanding into central business districts like BGC or Makati, understanding the true financial footprint is key to making informed decisions.

Below is a breakdown of the typical costs involved in leasing a 100 sqm traditional office in Metro Manila. These figures can serve as a benchmark for budgeting, whether you’re setting up a new headquarters or exploring your next stage of growth.

|

Total estimated setup cost: ₱3.2M–₱6.9M, before operations begin

Monthly operating cost: ₱150K+, on top of rent

Why This Matters For Your Business

For many growing businesses, rent is often seen as the primary cost when leasing office space. But in reality, rent is just the beginning. Traditional leases come with layered financial commitments that can have a lasting impact on your capital planning and operational efficiency.

Here’s what companies often encounter after signing:

- High upfront capital outlay for deposits, fit-out, and equipment

- Delays in build-out that push back operational readiness and revenue-generating activities

- Unbudgeted expenses such as permit fees, compliance requirements, or ongoing repairs

For businesses with stable revenues, a strong 5–7 year outlook, and in-house facilities management, these investments can be worthwhile. But for startups and fast-scaling teams, these costs can divert funding away from core drivers like talent acquisition, product development, or market expansion.

Updated Market Insights for Office Leases in the Philippines

Recent data provides a clearer lens on what businesses are really facing in today’s market:

- Lease rates in key CBDs such as Makati and BGC currently average ₱682 per sqm/month, with rates projected to remain stable in 2025.

- Fit-out costs in Metro Manila average $1,006 (~₱55,330) per sqm, putting a 100 sqm renovation budget at over ₱5.5 million.

- Office vacancy rates hit 19.8% in 2024, offering more leverage for tenants to negotiate flexible lease terms and concessions.

These figures underscore the importance of assessing total cost—not just rent—when deciding on your office strategy. Whether you’re moving in for the first time or planning to scale, knowing your numbers is a strategic advantage.

Key Financial Considerations in Traditional Leases

Traditional office leases are often valued for their stability, control, and long-term presence. But from a financial planning perspective, they also come with important cost implications that businesses—especially those in growth mode—need to prepare for.

1. Long-Term Lease Commitments (Typically 3–5 Years)

In Metro Manila’s prime business districts like BGC and Makati, commercial leases generally span three to five years. For established companies with predictable growth and stable cash flow, this can work well.

However, for startups or scale-ups navigating shifting market conditions, product pivots, or evolving team sizes, locking into a fixed-term lease may introduce financial friction.

Key cost considerations include:

- Pre-termination penalties, should your company need to downsize or relocate earlier than planned

- Non-refundable deposits, often equivalent to 3–6 months' rent

- Legal and broker fees involved in contract negotiation or early exit

According to Santos Knight Frank’s Q1 2024 Metro Manila Office Report, average rental rates in Makati stand at ₱1,035 per sqm per month. That puts a 100 sqm office at approximately ₱103,500/month, excluding utilities, maintenance, and support services.

2. Upfront Fit-Out Costs: Turning a Shell into a Workspace

Traditional leases typically provide a bare shell or warm shell space, meaning the interior is delivered unfinished. For many companies, this is an opportunity to design a workspace that reflects their brand and culture. But it also represents one of the largest upfront investments associated with office leasing.

Common fit-out components include:

- Interior construction – Partition walls, ceilings, lighting, and flooring

- Custom branding and signage – Reception areas, feature walls, company colors

- Office furniture – Desks, ergonomic chairs, meeting tables, storage solutions

- IT infrastructure – LAN cabling, routers, modems, server rooms

- Security systems – CCTVs, biometric access, fire alarms

- HVAC and electrical systems – Air-conditioning units, backup power, fire safety installations

Depending on design complexity and finish, fit-out costs in Metro Manila typically range from ₱10,000 to ₱20,000 per sqm. For a 100 sqm office, this translates to ₱1 million to ₱2 million upfront.

3. Ongoing Operational Costs: The Monthly Commitment

Beyond setup, traditional offices come with recurring costs that are often managed directly by the tenant. These can be predictable when planned for, but for growing businesses, they still represent a significant monthly financial commitment.

Typical operating costs include:

- Utilities – Electricity and water usage, especially high for tech-heavy or extended-hour operations

- Business-grade internet – Monthly plans can range from ₱8,000 to ₱30,000+, depending on speed and service-level guarantees

- Maintenance & cleaning – Janitorial services, HVAC servicing, pest control, and regular upkeep

- Security & administrative staffing – Guards, receptionists, and facilities coordinators add to headcount and payroll

- IT support – Whether outsourced or in-house, technical troubleshooting and downtime response are essential for continuity

When combined, these operating expenses typically range from ₱500 to ₱1,000 per sqm per month. For a 100 sqm office, that’s ₱50,000 to ₱100,000 monthly, in addition to rent.

4. Planning for Scale: Aligning Space with Growth

One of the most important considerations in office space planning is how well your setup can adapt to change. Traditional leases, by design, provide consistency and long-term presence. But they may not offer the same level of scalability as flexible models—especially for companies expecting rapid or unpredictable growth.

Here are common scenarios to consider:

- Team Expansion: A 100 sqm office might suit 10 people today—but what happens if your headcount triples in the next 12 months? Unless you've over-leased upfront, you may face relocation costs or outgrow your space mid-contract. Exiting early often means paying termination fees or negotiating with the landlord.

- Fluctuating Headcount: Businesses with seasonal teams or project-based work may not fully utilize their office year-round. Yet, rent and operational costs remain fixed, impacting your cost-per-employee ratio and overall efficiency.

- Relocation and Reinvestment: If growth or strategy requires moving to a larger (or more strategic) location, your existing capital expenditure—fit-out, branding, and furniture—often stays behind. This can mean writing off investments that no longer serve the business.

For companies that prioritize financial agility and operational flexibility, it’s important to ensure your lease model allows room to grow—or shift—as your business evolves.

5. Geographic Commitment: Evaluating Location Through a Financial Lens

A premium address in Makati, BGC, or Ortigas can elevate your company’s image and centralize your operations—but it also means a fixed geographic commitment, which may or may not align with the needs of your team or clients over time.

Here are several location-related cost factors to plan for:

- Employee Commute Burdens: If your team is spread across Metro Manila or even outside NCR—say, in Quezon City, Cavite, or Cebu—long daily commutes can lead to fatigue, lower productivity, or increased attrition. You may also need to subsidize transportation or offer remote alternatives, adding cost and complexity.

- Client Accessibility: If your client base is concentrated in areas like Alabang, Clark, or other growth corridors, travel from a fixed HQ in Makati or BGC could mean lost time and higher travel expenses—especially for frequent meetings or fieldwork.

- Hybrid Work Expectations: Post-pandemic, many employees prefer flexible work setups. A location-locked lease might limit your ability to attract top talent, particularly if your workforce expects options like satellite hubs or work-from-anywhere policies.

- Missed Opportunities in Emerging Hubs: Business districts evolve. If infrastructure development or market trends shift attention to new areas, being tied to a fixed location can limit your ability to respond—both operationally and financially.

While geographic consistency can offer brand and operational benefits, it’s worth balancing that against mobility, team distribution, and market accessibility—especially in fast-changing environments.

Key Considerations When Evaluating Traditional Office Leases

Traditional office spaces remain a viable and valuable option for many businesses—but understanding when they make the most financial and operational sense is critical. Below is a breakdown of the key advantages and considerations to help guide your planning.

Advantages of Traditional Office Leases

Traditional leases can offer strategic benefits, particularly for established companies with predictable growth and long-term operations:

- Full Control of Space: Customize your layout, branding, and workflow down to the last detail—ideal for teams that need specialized configurations or want to reflect a strong brand presence.

- Privacy & Exclusivity: A fully dedicated environment supports confidential work, high-concentration tasks, and full control over guest access.

- Long-Term Stability: Fixed terms can provide predictability for budgeting and operational planning, particularly helpful for finance teams managing multi-year forecasts.

- Prestige of Address: A location in a prime CBD like Makati or BGC can elevate brand perception and offer strategic proximity to key clients, partners, and institutions.

- Potential for Asset Gains (in select cases): Some agreements may include tenant improvement allowances or negotiated equity in build-out, offering a long-term return on investment.

Office Space Strategy: What’s Best for Startups?

For startups and high-growth companies, selecting the right workspace model is both a financial and operational decision. Traditional leases can offer control and brand presence, but they often require long-term commitments and capital that could otherwise be allocated toward product, hiring, or marketing.

Increasingly, startups are turning to flexible office arrangements that offer lower upfront costs, reduced setup time, and the ability to scale alongside the business. The goal isn’t to avoid traditional leases—it’s to choose the model that supports your financial strategy and growth priorities.

A Practical Middle-Ground for Modern Startups

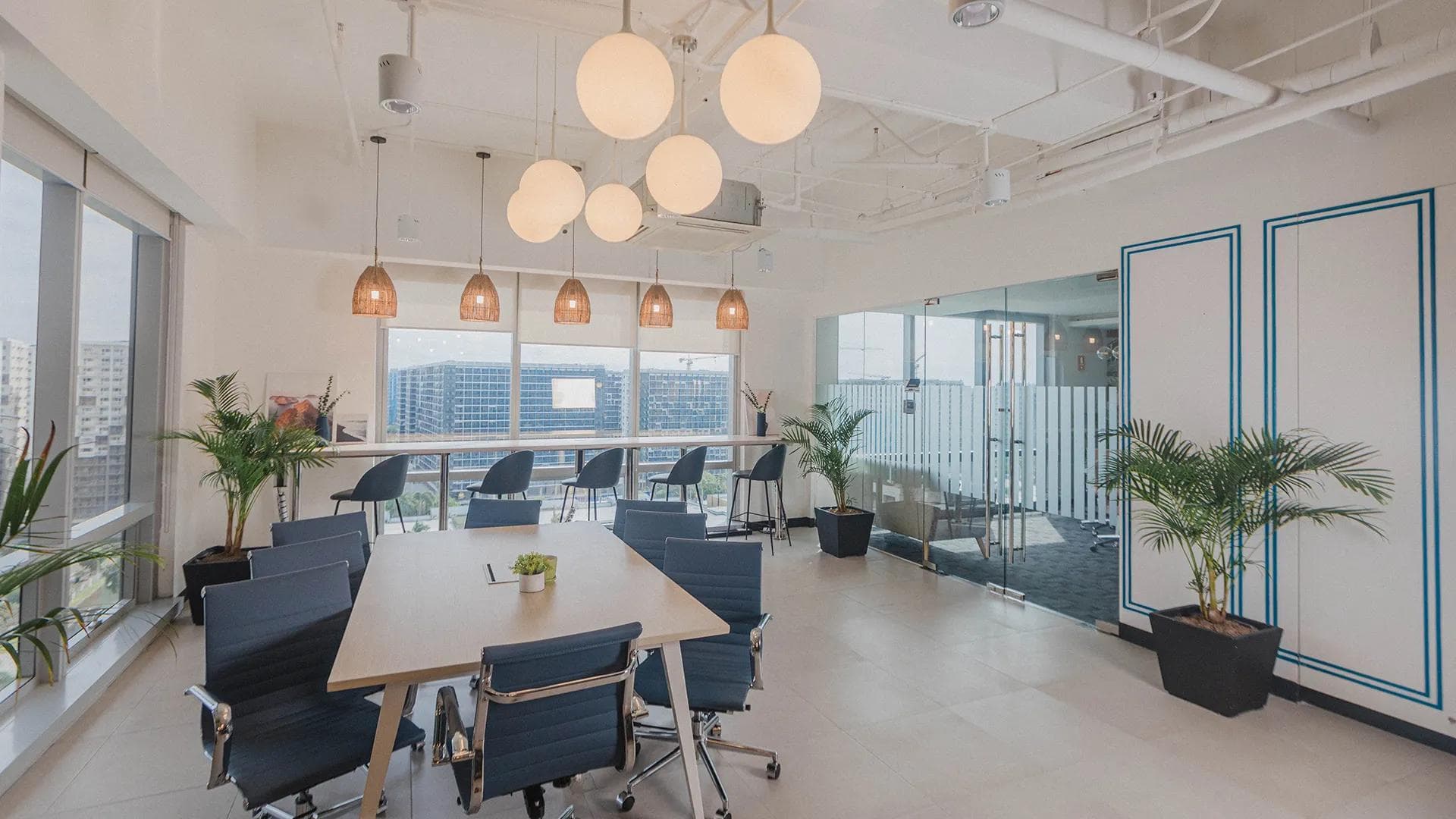

For many growing companies, KMC’s flexible office solution offers a strategic middle ground: the professionalism and infrastructure of a traditional office without the upfront financial burden or long-term commitments.

This model supports financial control, operational flexibility, and accelerated growth. It enables founders and finance teams to allocate capital where it drives the most value—from talent and tech to marketing and expansion.

In short: you don’t have to choose between control and flexibility. With the right workspace partner, you can have both that make financial sense.

Conclusion: Choose a Workspace That Supports Your Financial Strategy

Your office space isn’t just where your team works—it’s a line item on your balance sheet, a driver of operational efficiency, and a lever for growth. Whether you're scaling a startup or expanding into new markets, your workspace should reflect both your business model and financial plan.

Traditional office leases offer structure and long-term control—valuable for mature organizations with stable forecasts. But for companies navigating dynamic growth, shifting team needs, or tighter capital planning, flexible workspaces offer a more adaptable, cost-efficient alternative.

- Scale up or down based on real-time team needs

- Reduce upfront investment and preserve working capital

- Accelerate move-in timelines and reduce operational lift

The right space should enable and not restrict your growth. Choose a setup that aligns with where your business is today, and where it’s headed next.

Ready to explore workspace options built for growth and financial clarity?