Employer of Record vs Setting Up a Legal Entity: Which is Better for Your Business?

By Ailysh Velarde | 01/10/2025

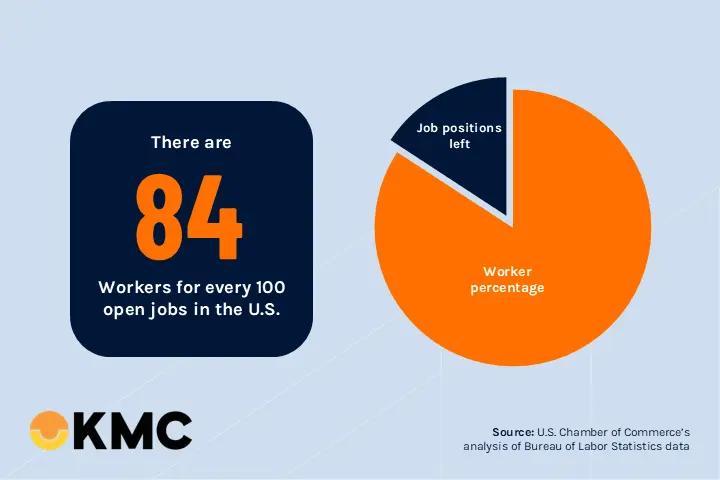

In a post-pandemic setting, businesses have increasingly turned to Employer of Record (EOR) companies or legal entity setups in the Philippines to expand globally or fill critical roles. This strategic move is particularly timely given the U.S. labor market's current shortage of workers. According to the U.S. Chamber of Commerce's analysis of Bureau of Labor Statistics data, in September 2024, the U.S. job market is characterized by a significant labor shortage, with a limited pool of workers available to fill numerous job openings.

The path to establishing a stable presence in the global market can vary significantly depending on your chosen approach. Two common methods are utilizing Employer of Record (EOR) services or setting up a legal entity in the selected country. This blog post will explore how each option operates in the Philippines, helping you make an informed decision based on your company’s goals, budget, and resources.

What Does an Employer of Record (EOR) Do for Your Company?

An Employer of Record or most known as EOR is a third-party service that acts as the official employer on behalf of an organization, handling essential tasks such as hiring, payroll, taxes, benefits, and compliance with local labor laws. This means that while your EOR is the legal employer of your international team, you retain full control over daily operations and employee performance.

An EOR simplifies hiring and managing a global workforce, allowing you to scale operations without establishing a formal business entity in the new market.

What Does a Legal Entity Do for Your Business?

A legal entity provides a formal structure that separates the business's legal responsibilities and assets from those of its owners, offering essential benefits to protect and organize the company. By establishing a legal entity, such as a corporation, LLC, or partnership, a business can enter contracts, own property, and hire employees under its name rather than its owners. This structure is crucial for managing liability because it typically limits the personal financial risk of the business owners, as their assets are generally protected from debts and liabilities incurred by the business.

What are the Areas of Consideration in Using an Employer of Record (EOR) vs a Legal Entity in the Philippines?

What are the Requirements for Setting Up a Legal Entity in the Philippines?

Establishing a legal entity in the Philippines involves several steps, especially for foreign-owned companies. Key steps include:

1. Registering a Company Name: File and register your chosen company name with the Department of Trade and Industry (DTI).

2. Obtaining Local Business Permits: Secure business permits from the local government unit where your operations will take place, including Barangay clearance.

3. Registering with Government Agencies: Register with the Bureau of Internal Revenue (BIR) and other mandatory organizations such as the Social Security System (SSS), PhilHealth, and HDMF (Pag-IBIG Fund).

4. Compliance with Employment Regulations: Ensure that your business meets local employment standards and is registered with the Department of Labor and Employment (DOLE) if hiring employees in the Philippines.

When to Switch from an Employer of Record (EOR) to Your Own Legal Entity?

As your business grows and becomes more established in the Philippines, there may come a time when transitioning from an EOR to your own legal entity makes financial and operational sense. Generally, companies should consider this shift when they have a substantial local workforce, established revenue streams, and long-term plans for market presence. At this stage, establishing a legal entity can reduce monthly service fees, offer greater operational control, and better support sustained growth in the local market.

Conclusion

An Employer of Record (EOR) service, as provided by KMC Teams, manages a streamlined, cost-effective path for businesses to expand internationally, handling payroll, compliance, and local hiring without the need for a legal entity. While setting up a local entity offers full operational control, it’s a time-intensive process best suited for businesses with significant market presence. For companies seeking manageable, efficient expansion, an EOR is a strategic solution that reduces compliance risks and accelerates global growth. Partnering with KMC Solutions allows businesses to scale confidently, ensuring that their workforce remains compliant, well-supported, and ready to contribute to new market success.

Weighing the advantages of Employer of Record?