Key Insights on Getting an Employer of Record in the Philippines

By Ailysh Velarde | 12/13/2024

As businesses venture into international markets, they often find their resources stretched thin, especially regarding costs, time spent on hiring and training suitable team members. To address these challenges, many businesses rely on solutions like an employer of record (EOR), leveraging the Philippines' trusted and diverse talent pool.

However, there are still common problems businesses encounter when they hire talent directly in the Philippines. This is why strategically working with local partners or services like Employers of Record (EOR), such as KMC Teams, further simplifies and handles this process on behalf of the organization, allowing businesses to focus on their core objectives and growth.

Understanding Employer of Record (EOR) Services in the Philippines: Why Businesses Choose an Employer of Record in the Philippines

In the Philippines, employment types can vary, including full-time, part-time, contractual, and project-based roles. Each type has specific regulatory requirements that an employer of record (EOR) must navigate, ensuring compliance with the Labor Code.

What is an Employer of Record?

An Employer of Record (EOR) in the Philippines help businesses by managing essential functions like recruitment, onboarding, HR, payroll, compliance, and employee benefits— eliminating the need for organizations to establish a costly local entity.

Understanding the cultural nuances of working in the Philippines is key to effective team management. The country values collaboration, respect, and clear communication—factors that an employer of record (EOR) considers when managing employee relationships on behalf of a company.

How Do Employer of Record (EOR) Services Benefit Businesses?

The hiring process in the Philippines can sometimes be complex, with mandatory checks, interviews, and compliance with local labor standards. Acquiring employer of record (EOR) services streamlines this process by leveraging local expertise to manage recruitment efficiently, effectively and apt for the certain business.

The partnered employer of record (EOR) legally employs your team, acting as their official employer while you retain full control over their daily work and performance. This service is ideal for companies aiming to scale globally, cut operational expenses, and navigate the complex legal and compliance requirements of managing an international workforce.

What Are the Cost Considerations of Using an Employer of Record (EOR)?

When exploring the Employer of Record (EOR) services in the Philippines, understanding the associated costs is essential for more effective budgeting and strategic planning. The costs of partnering with an employer of record (EOR) usually include a service fee that covers compliance management, payroll, HR Functions, and other administrative tasks. Fees may vary depending on the provider and the scope of services needed, but opting for an employer of record (EOR) is often more efficient than establishing a local entity. Financial clarity helps businesses allocate resources better while ensuring comprehensive compliance with Philippine labor laws.

Still on the fence about Employer of Record (EOR) effectiveness in the Philippines?

What Should You Know About Employment Regulations in the Philippines

The Philippines crafts employment regulations to uphold fair working conditions, ensuring both employee welfare and structured guidelines for employers. Under Book III: Conditions of Employment, issued by the Department of Labor and Employment (DOLE), these regulations detail essential aspects, from working hours to compensation guidelines, working hours, overtime pay, types of leave, employee benefits, and supporting a balanced and equitable workplace.

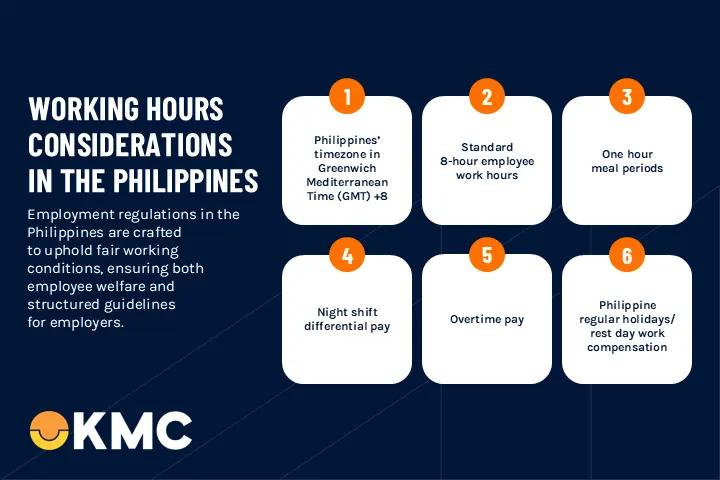

Understanding Working Hours and Overtime

1. Philippines’ time zone is Greenwich Mediterranean Time (GMT) +8:

Operating in the GMT+8 time zone, the Philippines runs eight hours ahead of Greenwich Mean Time. For international collaborations, optimal meeting times often fall between 4:00 PM to 6:00 PM (GMT+8), aligning with early morning hours (8:00 AM to 10:00 AM) in GMT, facilitating smooth cross-time zone communication.

2. Standard Employee Work Hours:

Article 23 caps the standard employee workweek at eight hours daily, five days a week, totaling forty hours, to promote work-life balance and maintain productivity without overexertion. Any work beyond these hours falls under overtime, which comes with additional pay entitlements.

3. Meal Periods:

Article 85 entitles every employee to at least a 60-minute meal break during an eight-hour shift, supporting their physical and mental well-being to help them recharge and stay productive.

4. Night Shift Differential:

According to Article 86, for those working night shifts between 10:00 PM and 6:00 AM, the law mandates an additional 10% of the hourly rate as compensation. This “night differential pay” acknowledges the challenges of nighttime work and compensates employees accordingly.

5. Overtime Pay:

Article 87 entitles employees working beyond eight hours to their standard wage plus an additional 25% of their hourly rate.

6. Philippine Regular Holidays/Rest Day Work Compensation:

For work on regular holidays or rest days as stated in Article 87, employees earn an additional 30% of their regular hourly rate for hours worked beyond 8. This policy reinforces fair compensation for working on days traditionally reserved for rest or celebration.

Why Employment Regulations Matter for Both Employers and Employees

For international and private employers, compliance with these regulations is essential to fostering a lawful, respectful, and motivating work environment in the Philippines.

For employers, adhering to these standards means:

- Preventing the exploitation of workers

- Builds employee trust

- Reduces the risk of legal disputes and complications

For employees, these rights aim to:

- Promote and maintain physical and mental well-being

- Work-life balance

- Improve job satisfaction and productivity

By partnering with an Employer of Record (EOR) like KMC Teams, businesses can navigate complex labor considerations to create a positive, productive, and compliant workplace that respects the rights and needs of all stakeholders. An employer of record (EOR)’s expertise in the Labor Code ensures seamless compliance, reduces the risk of legal disputes, and fosters a lawful work environment, enabling smooth and efficient business operations.

What Types of Leaves Are Available in the Philippines?

The Philippines recognizes various types of leave to support the employees' welfare involving their personal and family responsibilities. While not all leaves are mandated by law, it is standard practice for employers to include them in contracts for the benefit of employees.

- Sick Leave: While not legally mandated, employees can use their five-day Service Incentive Leave (SIL) for illness once they’ve completed one year of service.

- Vacation Leave: Not mandated by law but commonly provided by employers. Companies should outline eligibility and accrual rates in contracts.

- Maternity and Paternity Leave: Female employees receive at least six weeks of paid maternity leave, while married male employees can take up to seven days of paid paternity leave for the first four deliveries of their spouse.

- Solo Parent Leave: Eligible employees, after one year of service and providing a Solo Parent ID, receive leave for solo parenting responsibilities. Employees typically cannot convert unused leave to cash.

- Bereavement Leave: While not mandatory, many employers provide bereavement leave, often ranging from two to ten days, to allow employees time to grieve.

- VAWC Leave (Violence Against Women and Children): Female employees who experience violence can take up to 10 days of paid VAWC leave for medical and legal assistance, with extensions based on their situation.

How Employer of Record (EOR) Services Ensure Compliance and Support Employee Welfare

Employer of Record (EOR) services in the Philippines, such as those provided by KMC Teams, streamline the administration and compliance of diverse leave entitlements, ensuring regulatory adherence and robust support for employee welfare. By managing standard and special leave requirements seamlessly, KMC’s employer of record (EOR) model reduces administrative burdens for businesses, allowing them to focus on core operations.

Additionally, employer of record (EOR) services helps companies maintain compliance with local labor laws while fostering a supportive work environment through precise coordination of leave benefits. This approach not only enhances employee welfare but also strengthens the company’s reputation as a conscientious employer. By outsourcing compliance, businesses can mitigate significant costs associated with administrative expenses and potential fines, ensuring lawful and efficient operations in the Philippines.

What is the Daily Minimum Wage Standard in the Philippines?

Effective July 17, 2024, under Wage Order No. NCR-25, the daily minimum salary wage in the Philippines, particularly in the National Capital Region (i.e. in Metro Manila) now ranges from ₱608 to ₱645 ($10.43 to $11.06 USD), aiming to align wages with the rising cost of living.

What are the Key Employee Benefits in the Philippines?

Employers provide comprehensive benefits packages to promote employee well-being and financial security.

1. Health Maintenance Organization (HMO)

Employers are health plan benefits to their accredited hospital or clinic partner of the employer and will be given to their employees when they are under hospitalization, accidents

2. 13th-Month Pay

As stated in the DOLE’s Worker Statutory Monetary Benefits – the 2023 edition, all employers, either in the private or the public sector are mandated to give their employees in the Philippines their respective bonuses given not later than December 24 of every year.

3. Non-Taxable Allowances

Non-taxable allowances refer to specific benefits provided to employees that are not subject to income tax. In the private sector, these allowances are often limited to essentials that support day-to-day work, making them particularly beneficial in offsetting common expenses.

Key Types of Non-Taxable Allowances

- Meal Stipends: This allowance helps cover the cost of daily meals, making it easier for employees to focus on work without worrying about meal expenses.

- Transport Stipends: Covering travel-related costs, this allowance helps ease the financial burden of commuting, which is often a significant expense, especially in urban areas.

Employment Contracts and Termination Policies

An employment contract is the cornerstone of the employer-employee relationship, outlining the terms, expectations, and mutual responsibilities. It provides clarity on job roles, compensation, and conduct expectations, establishing a clear foundation for the employment journey. Here are the types of contracts or policies of a company:

Regular Employment Contracts

A formal agreement outlining the terms and circumstances of a continuous employment relationship between an employer and employee is known as a regular employment contract. In contrast to temporary or freelance workers, it is usually applied to permanent employees who are employed for an extended period of time.

Fixed Term Employment Contract

An employment agreement that establishes a termination date or length for the employment relationship is known as a fixed-term employment contract. In contrast to an open-ended normal (permanent) work contract, a fixed-term contract has a set duration or project, after which it automatically terminates unless it is renewed or extended.

Probation Period

The probation period is generally the first few months of employment and serves as a testing phase for both employers and employees. During this period (typically capped at six months), employers can assess if the employee fits well within the role and the company culture. For employees, it’s an opportunity to determine if the organization aligns with their professional goals and values. Clearly defining the probation period in contracts ensures that both sides have aligned expectations and helps facilitate early intervention if adjustments are necessary.

Termination of Employment

Defined termination policies promote fairness and consistency, ensuring that employees are given a notice period—usually a month—which allows for planning and transition.

Severance Pay

Severance pays reflects the organization’s commitment to supporting employees who may be leaving under specific circumstances. Providing severance pay—one month’s salary for every year of service—demonstrates a commitment to employee welfare and enables smoother transitions.

What Mandatory Employment Taxes and Contributions Does an Employer of Record Handle in the Philippines?

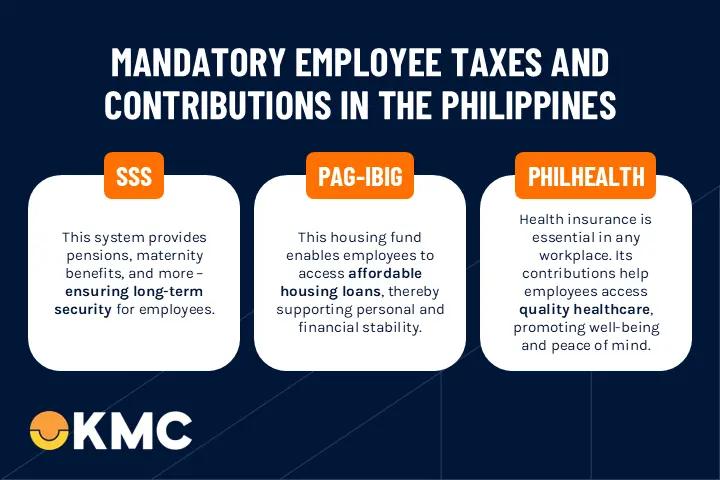

In addition to salaries, employers and employees must contribute to mandatory social service systems, which cover various aspects of well-being:

1. SSS (Social Security System)

This system provides pensions, maternity benefits, and more, ensuring long-term security for employees.

2. Pag-IBIG Fund

This fund benefits Filipino employees by providing reliable savings programs as well as access to affordable housing loans, thereby supporting their personal and financial stability.

3. PhilHealth

Health insurance is essential in any workplace, and PhilHealth contributions help employees access quality healthcare, promoting well-being and peace of mind.

How Employer of Record (EOR) Services Simplify Compliance with Philippine Wage, Benefits, and Employment Policies

Incorporating Employer of Record (EOR) services enables businesses to navigate and timely address the complexities of Philippine wage laws, employee benefits, and employment policies with ease and precision.

By outsourcing critical compliance functions, it supports employee satisfaction and financial security but also upholds a company’s reputation as a compliant and responsible employer. EOR services handle these essential aspects, allowing businesses to focus on their core operations while ensuring their workforce remains supported and compliant with Philippine labor laws.

KMC’s Employer of Record Services in the Philippines

While employer of record (EOR) services offers numerous benefits, it’s important to be aware of potential pitfalls, such as limited control over HR policies and potential misalignment with company culture. Managing these complexities requires more than just ambition—it demands a strategic approach that minimizes risk and maximizes efficiency. However, for private sector employers, this journey can be complicated by:

- Compliance demands or legal disputes

- Dynamic operational costs

- Unfamiliar hiring practices and cultures

- Local regulations

This is where companies should partner with trusted Employer of Record (EOR) service providers in the Philippines like KMC Teams.

Instead of facing the daunting task of establishing a local entity, handling extensive HR requirements, tax regulations, and managing payroll compliance, an employer of record (EOR) steps in as the legal employer on your behalf. KMC Teams’ employer of record (EOR) services manage recruitment, onboarding, payroll, benefits administration, and compliance, all while you retain control over daily operations and team performance.

KMC's employer of record (EOR) services enable private sector employees to expand smoothly and cost-effectively, ensuring they confidently meet every regulatory requirement.

See the value we deliver, in our clients’ words.