Top 5 Outsourcing Destinations: Quick Facts and Why the Philippines Stands Out

By Gian Reyes | 09/27/2024

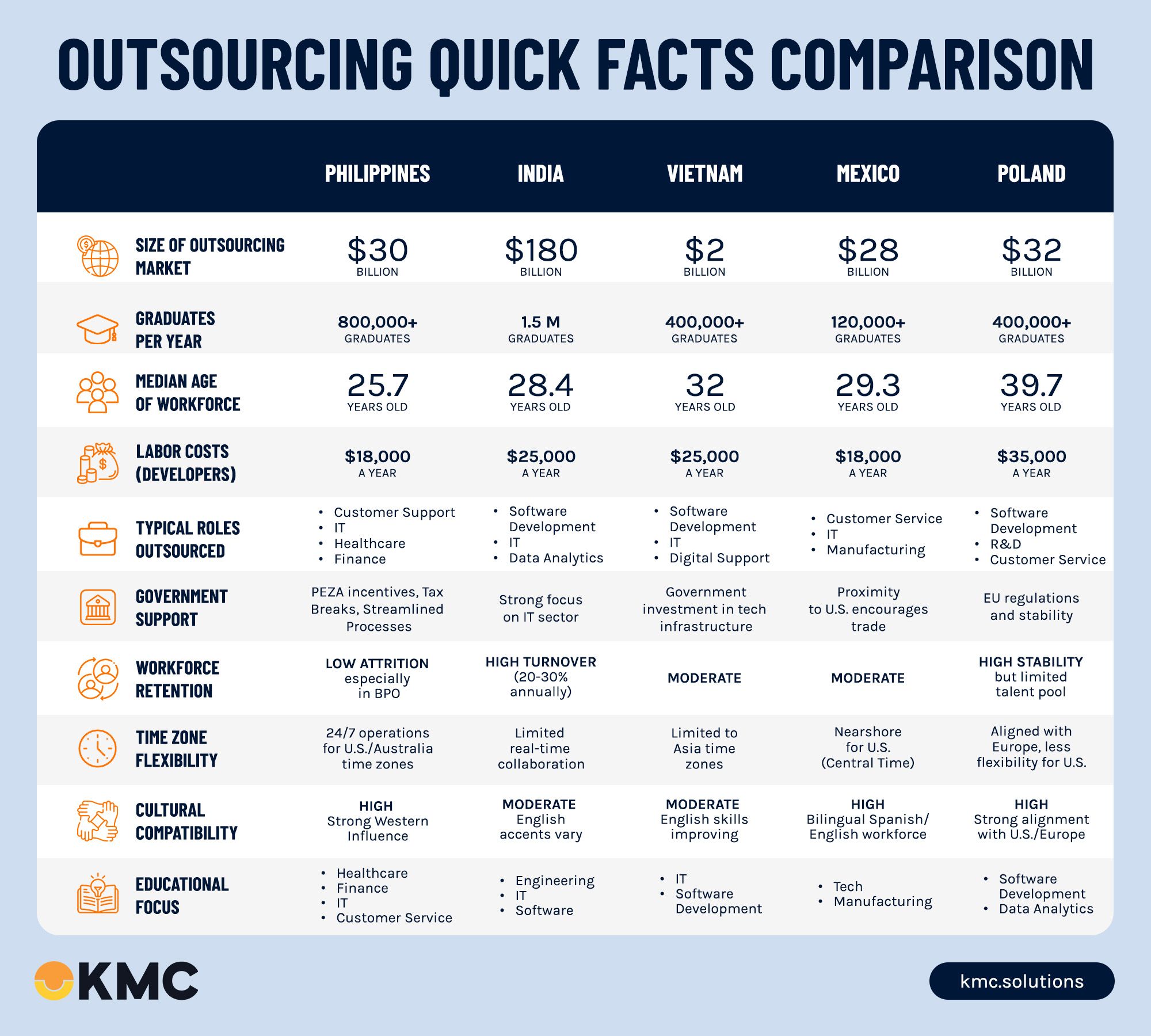

If you're scaling your business, outsourcing is a smart move. But where should you outsource? We break down the top five destinations with quick facts under consistent categories so you can easily compare.

Spoiler alert: The Philippines takes the lead. Here’s why.

1. Philippines: The Outsourcing Powerhouse

The Philippines is often referred to as the "BPO Capital of the World" for a reason. With a thriving outsourcing industry driven by over 1.3 million workers and annual revenues of $30 billion, the Philippines excels in customer service, back-office support, IT, healthcare, and more. Its combination of low labor costs, cultural compatibility, and strong government backing makes it a top choice for businesses looking to scale efficiently.

· Size of Outsourcing Market

$30 billion, representing 11% of the country’s GDP.

· Graduates per Year

800,000+, with specializations in healthcare, IT, and finance.

· Median Age of Workforce

25.7 years, ensuring a young and adaptable workforce.

· Labor Costs (Developers)

$18,000/year—competitive globally, with a solid talent pool.

· Typical Outsourced Roles

Customer support, IT services, healthcare support, financial services, and software development.

· Government Support

The Philippine government provides PEZA incentives like tax breaks and streamlined processes, making it easier and cheaper to operate.

· Workforce Retention

Low attrition rates in key sectors, ensuring stability and continuity.

· Time Zone Flexibility

24/7 workforce availability, perfectly aligned with U.S. and Australian time zones.

· Cultural Compatibility

High cultural alignment with Western countries, particularly in customer-facing roles.

· Educational Focus

Strong emphasis on healthcare, IT, finance, and customer service, giving the Philippines a versatile talent pool.

2. India: The IT and Software Leader

India has long been synonymous with outsourcing, particularly for its IT and software development prowess. With a massive outsourcing industry valued at $180 billion and a vast talent pool, India remains a global leader in technology-related services. However, rising labor costs and high turnover rates in certain sectors indicate that India might not be the most cost-effective solution across all industries.

· Size of Outsourcing Market

$180 billion, primarily driven by IT and tech services.

· Graduates per Year

1.5 million, producing more engineers and IT professionals than any other country.

· Median Age of Workforce

28.4 years, with a strong pipeline of skilled workers.

· Labor Costs (Developers)

$25,000/year, more expensive for non-tech roles.

· Typical Outsourced Roles

Software development, IT services, data analytics, and back-office support.

· Government Support

India has robust support for its IT sector but faces more bureaucratic hurdles in other industries.

· Workforce Retention

India has a large and skilled talent pool in the IT sector as a major advantage but with high turnover rates (up to 30% annually) which can lead to operational disruptions, making long-term continuity a challenge.

· Time Zone Flexibility

Limited overlap with U.S. time zones that can challenge real-time collaboration.

· Cultural Compatibility

Good English proficiency, but varying accents and cultural nuances can impact communication.

· Educational Focus

Engineering, IT, and software development are the primary educational strengths.

3. Vietnam: A Rising Tech Star

Vietnam is rapidly emerging as a competitive player in the global outsourcing market, particularly in IT services and software development. With strong government investment in tech infrastructure and an affordable labor force, Vietnam offers attractive options for companies looking to outsource their digital and tech needs. While it’s still catching up in terms of English proficiency and infrastructure, Vietnam’s potential for growth is undeniable.

· Size of Outsourcing Market

$2 billion, with tech services driving most of the growth.

· Graduates per Year

400,000+, focusing on IT and engineering.

· Median Age of Workforce

32 years, blending experience with innovation.

· Labor Costs (Developers)

$18,000/year, similar to the Philippines but with a less developed infrastructure that may affect operational efficiency.

· Typical Outsourced Roles

Software development, IT services, e-commerce support, and digital marketing.

· Government Support

The Vietnamese government is heavily investing in its tech infrastructure to position the country as a key outsourcing player.

· Workforce Retention

Moderate retention rates, with improving employee loyalty.

· Time Zone Flexibility

Limited overlap with Western time zones, but ideal for Asia-Pacific clients.

· Cultural Compatibility

English proficiency is improving, but still lags behind the Philippines and India.

· Educational Focus

Strong in IT and software development, with growing expertise in digital marketing.

4. Mexico: Nearshoring Proximity to the U.S.

For North American companies, Mexico offers the advantage of proximity, shared time zones, and a bilingual workforce. With a $28 billion outsourcing market, Mexico has a well-established base in manufacturing and IT services, though labor costs are higher compared to Asian destinations. Mexico is particularly strong in nearshoring solutions, making it a top choice for businesses that prioritize geographic closeness over cost savings.

· Size of Outsourcing Market

$28 billion, largely driven by proximity to the U.S.

· Graduates per Year

120,000+, focused on tech and engineering.

· Median Age of Workforce

29.3 years, offering a blend of youth and experience.

· Labor Costs (Developers)

$35,000/year, higher than in Asia but still lower than the U.S.

· Typical Outsourced Roles

Customer service, IT support, manufacturing, and software development.

· Government Support

Proximity to the U.S. which fosters strong trade relationships, though government incentives specific to outsourcing are more limited compared to Asia.

· Workforce Retention

Moderate retention rates, but workforce stability varies across different sectors.

· Time Zone Flexibility

Nearshore advantage for U.S. companies, with Central Time zone alignment.

· Cultural Compatibility

A bilingual Spanish-English workforce offers strong cultural alignment, particularly for U.S. businesses.

· Educational Focus

Focused on tech and manufacturing but lacks the versatility found in other outsourcing markets.

5. Poland: Europe’s Tech and R&D Hub

Poland has become a key outsourcing destination for European companies, especially in software development and R&D. Its highly educated workforce, backed by strong EU regulations, makes it a reliable option for businesses looking for quality, although it comes at a higher cost than outsourcing to Asian countries.

· Size of Outsourcing Market

$32 billion, driven by IT and software development.

· Graduates per Year

400,000+, with a strong focus on STEM fields.

· Median Age of Workforce

39.7 years, offering experience, but not as youthful as Asia’s workforce.

· Labor Costs (Developers)

$45,000/year, significantly higher than in Asian countries.

· Typical Outsourced Roles

Software development, R&D, data analytics, and customer service.

· Government Support

As part of the EU, Poland offers regulatory stability, but fewer dedicated outsourcing incentives compared to other leading destinations.

· Workforce Retention

High stability, but a limited talent pool for non-tech roles.

· Time Zone Flexibility

Aligned with Europe but less flexible for U.S.-based operations.

· Cultural Compatibility

Strong alignment with Western Europe and the U.S., but its more formal communication and rigid business practices may make the adaptable, service-oriented approaches of Asian countries a better fit for Western clients.

· Educational Focus

Primarily in software development and engineering, with less focus on broader outsourcing sectors like customer support or healthcare.

The Philippines Leads in Versatility and Value

Each of these outsourcing destinations has its unique strengths and challenges. India excels in IT services, Vietnam is emerging as a rising star in tech, Mexico offers strategic proximity for U.S. companies, and Poland serves as a reliable option for European firms. However, the Philippines stands out as the premier destination for outsourcing, dominating key metrics such as cost, cultural fit, and workforce adaptability. With a compelling combination of government support, low labor costs, and a young, highly skilled workforce, the Philippines is the best all-around choice for customer service, IT services, healthcare support, and back-office operations.

If you're thinking about building an extension of your team in the Philippines, KMC Teams makes it easy. We take care of recruitment, onboarding, and management, so you can focus on scaling your business.

Contact us today to learn how we can help you grow efficiently and seamlessly.