Build Your Fintech Team in the Philippines and Colombia

Scaling Fintech Teams Is Increasingly Complex

Fintech companies are growing quickly across payments, digital banking, risk, and financial infrastructure. As demand rises for specialised talent in areas such as compliance, security, data, and engineering, many organisations face challenges hiring locally due to cost pressure, limited talent supply, and regulatory complexity.

To address this, many fintech firms build dedicated teams in the Philippines and Colombia—markets with established talent pools and experience supporting regulated financial operations.

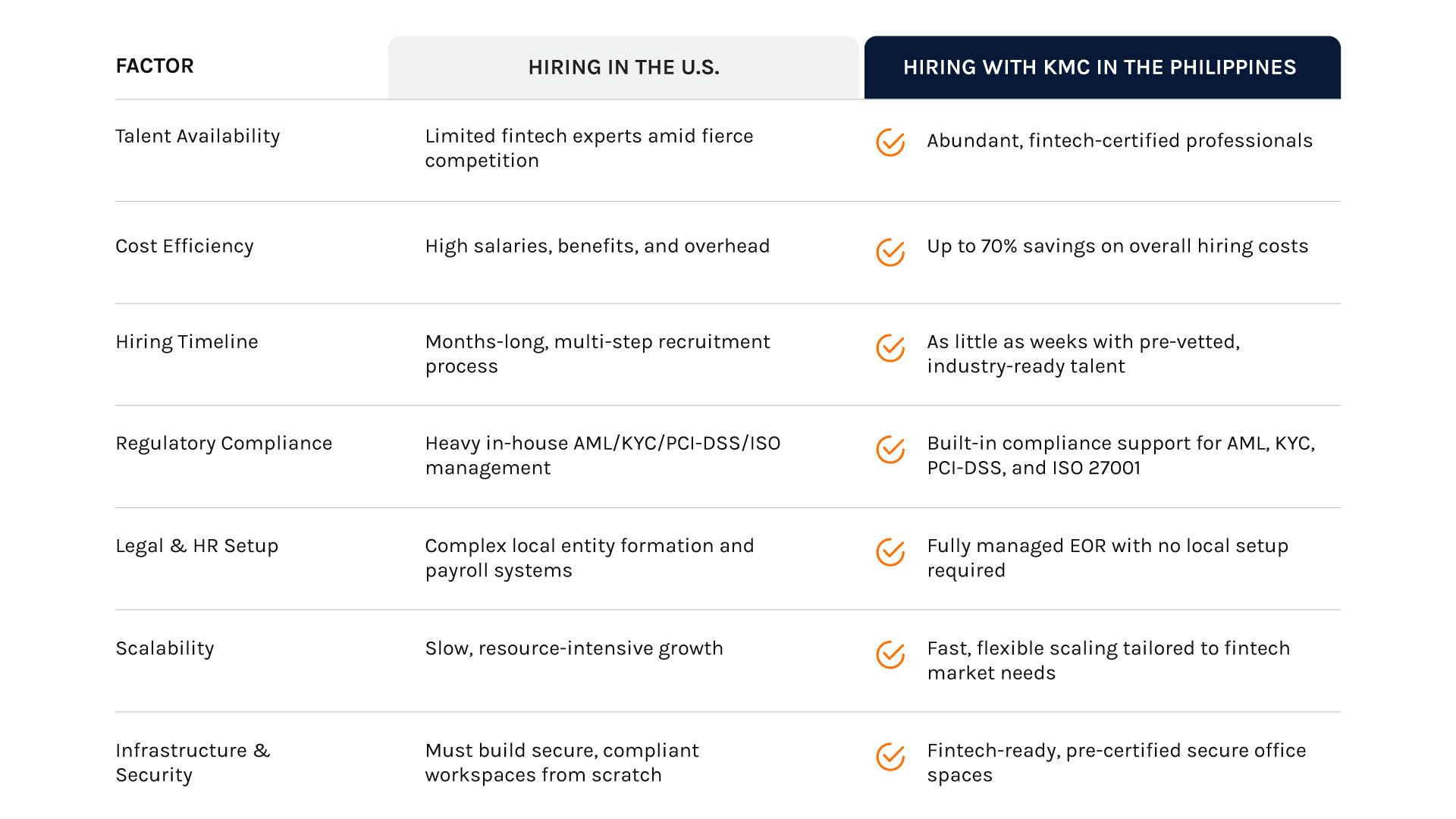

Weighing Your Options?

Hiring Locally?

Rising salary expectations, limited availability of specialised fintech professionals, and retention challenges can slow team expansion.

Traditional Outsourcing?

Outsourcing models often limit operational control, reduce transparency, and introduce compliance or security concerns.

There’s a Better Way – Build a High-Performing Fintech Team with Ease

Build Dedicated Fintech Teams with KMC Solutions

KMC Solutions enables fintech companies to hire and manage dedicated professionals in the Philippines and Colombia without setting up local entities.

Teams work under your direction, using your tools and processes, while KMC manages employment, payroll, and local compliance.

What You Gain with KMC Solutions

Fintech-Experienced Talent

Mid-to-senior professionals across compliance, engineering, data, and operations with experience supporting financial technology environments.

Operational Control

You retain full control over hiring decisions, workflows, performance management, and day-to-day operations.

Compliance-Ready Support

Teams are supported through employment structures aligned with regulatory requirements relevant to fintech operations.

Secure Work Environments

Access to enterprise-grade office infrastructure designed to support regulated financial services.

Key Challenges Fintech Companies Face Today

Specialized Talent Shortages

Competition for experienced professionals in payments, fraud prevention, and financial security continues to intensify.

Regulatory and Compliance Pressure

Managing AML, KYC, data protection, and financial reporting requirements requires consistent operational support.

Rising Operating Costs

Building and maintaining fintech teams in high-cost markets places pressure on margins.

Security and Infrastructure Demands

Financial platforms require stable, secure, and compliant operating environments.

Fintech Team Support with KMC Solutions

KMC Solutions supports fintech companies across engineering, compliance, risk, and operations—providing the employment, infrastructure, and operational support required to build stable, long-term teams in the Philippines and Colombia.

Top-Tier Fintech Talent

Specialists in financial technology development, risk assessment, and regulatory compliance.

Faster Team Expansion

Hire and onboard fintech professionals in weeks, not months, while ensuring full regulatory compliance.

Cost-Efficient Scaling

Reduce hiring costs by up to 70% while maintaining top-tier expertise and security.

Trusted by Industry Leaders

Global fintech firms rely on KMC for fully managed, high-performance teams.

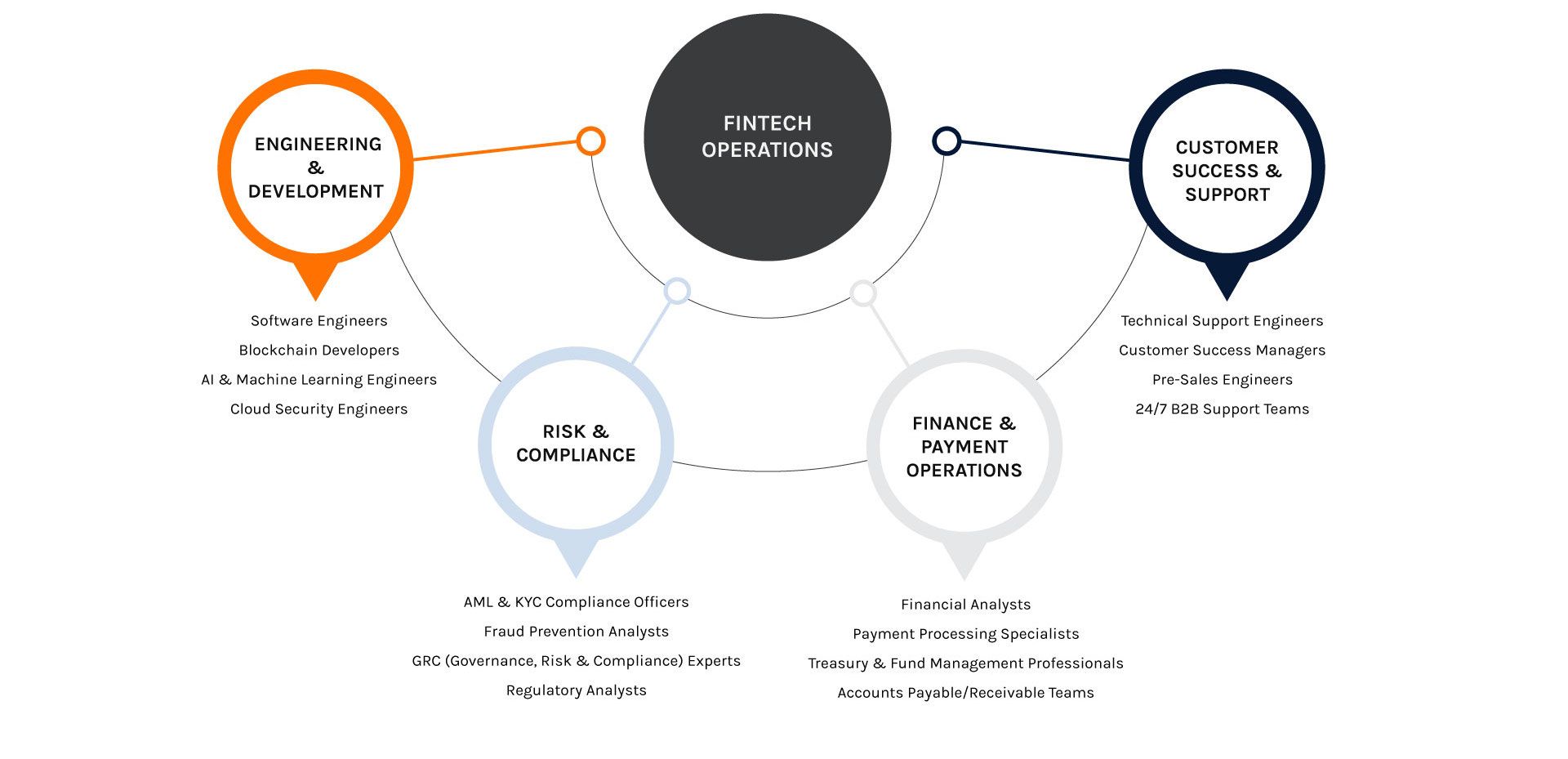

What Fintech Roles Can You Hire in the Philippines?

KMC Solutions provides highly skilled professionals across financial technology, risk management, compliance, and customer operations, ensuring expertise, regulatory compliance, and seamless financial operations.

Engineering & Product Development

- Software Engineers (payments, banking platforms, APIs)

- Blockchain and distributed ledger developers

- AI and machine learning specialists (fraud detection, risk models)

- Cloud and application security engineers

Risk & Compliance

- AML and KYC compliance analysts

- Fraud prevention and transaction monitoring specialists

- Governance, risk, and compliance (GRC) support roles

Finance & Operations

- Financial analysts and controllers

- Payment operations and reconciliation specialists

- Treasury and fund operations support

Customer Support & Operations

- Technical support specialists

- Customer success managers

- B2B customer support teams supporting fintech platforms

Teams are structured based on your operating model, regulatory requirements, and technology stack.

How Fintech Teams Work with KMC Solutions

1

Define Team Requirements

Align on roles, compliance needs, security requirements, and workflows.

2

Recruit and Hire

Source fintech professionals in the Philippines or Colombia based on experience and role scope.

3

Employ and Onboard

KMC manages contracts, payroll, and statutory compliance locally.

4

Operate and Scale

Teams receive ongoing HR and operational support while you manage delivery, performance, and priorities.

Building a Global Fintech Team with KMC Solutions

Why Fintech Companies Work with KMC Solutions

Experience supporting regulated industries

Established operations in the Philippines and Colombia

Transparent employment-led model (not project outsourcing)

Secure, enterprise-grade work environments

Ability to scale from individual contributors to full fintech teams

KMC Solutions supports fintech companies that require control, compliance, and long-term team stability.

Stories of Growth: How UniFi Books Scaled Its Financial Services Team with KMC Solutions

The Challenge: Expanding Financial Operations Without the Usual Roadblocks

UniFi Books, a California-based fintech firm, needed a scalable, cost-effective workforce solution to support its digital bookkeeping, regulatory reporting, and financial automation services.

Key Challenges:

- Limited access to top-tier fintech professionals in the U.S.

- Rising costs of hiring financial analysts and compliance officers

- The need for a fully integrated, secure, and scalable workforce solution

The Solution: A Fully Integrated Fintech Team with KMC

- Strategic Workforce Expansion – KMC established Ortigas as UniFi’s HQ, with Clark as a satellite office for talent acquisition.

- Rapid Hiring & Onboarding – 10+ finance and compliance professionals onboarded in just three weeks, filling key roles.

- Regulatory & Compliance Handling – KMC ensured full alignment with AML, KYC, PCI-DSS, and ISO 27001 regulations.

- Scaled from 30 to 100+ fintech professionals in under six months

- Achieved full compliance with global financial security standards

- Optimized operational costs while enhancing security & efficiency

Now, UniFi operates a high-performing, scalable fintech team—without the hassle of legal entity setup or compliance risks.

See What Some of Our 400+ Clients Say

Talk to KMC Solutions

If you are planning to build fintech teams in the Philippines or Colombia, KMC Solutions can support recruitment, employment, onboarding, and compliance—so your teams can scale with confidence and operational clarity.

Let’s build your world-class fintech team today.