Extend Your Global Fintech Team in the Philippines (For Australian Companies)

Scaling Fintech Teams Has Never Been More Challenging

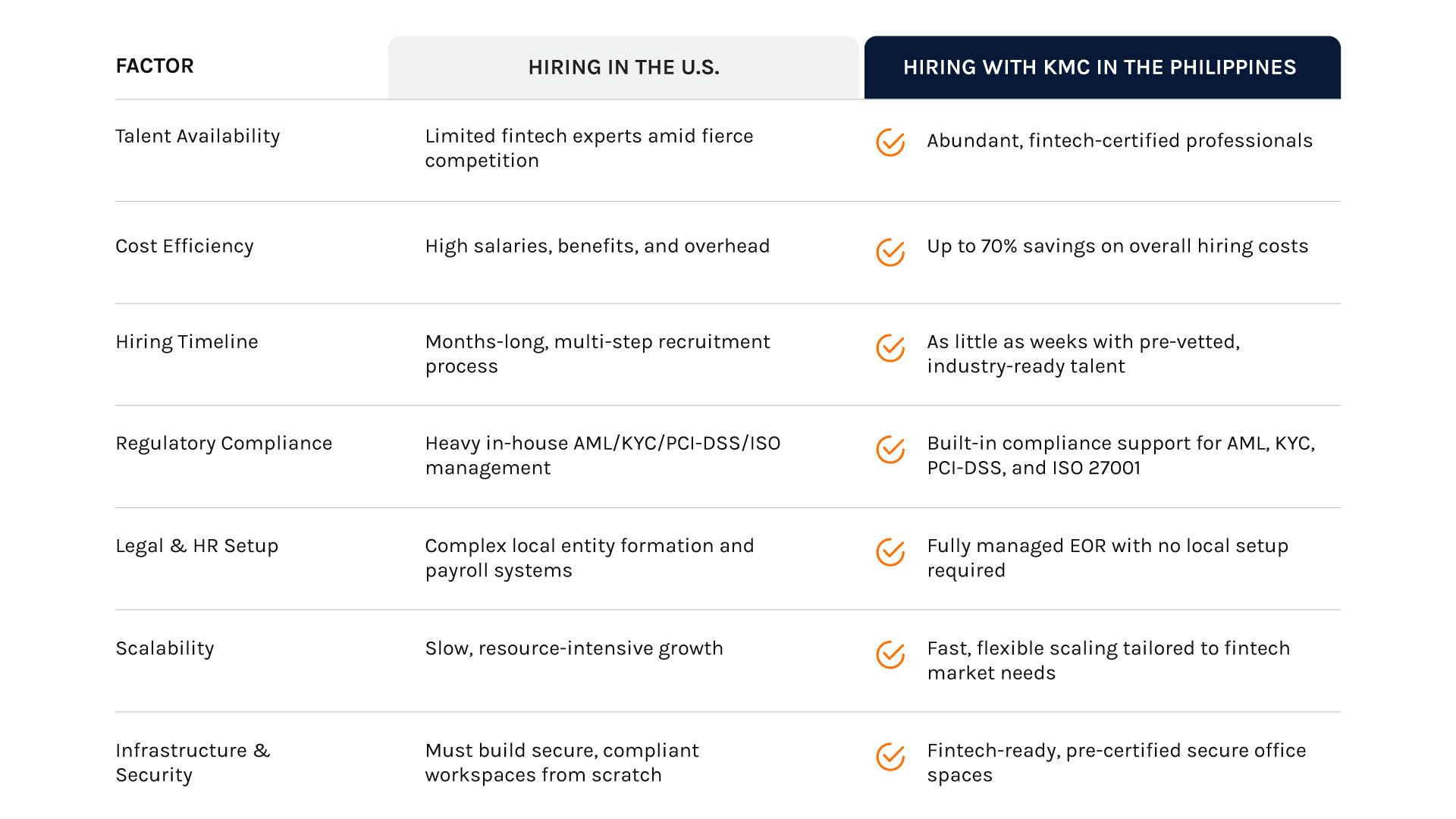

Fintech is surging—and so are demands for specialists in digital payments, fraud/AML, blockchain, AI‑driven risk and cloud security. In Australia, talent scarcity, rising salaries and tight regulations make hiring slow and costly.

Weighing Your Options?

Hiring locally?

Limited availability, premium salary bands and retention headwinds stretch timelines and budgets.

Outsourcing?

Traditional BPOs reduce control and agility—and can introduce compliance risk.

There’s a Better Way – Build a High‑Performing Fintech Team with Ease

Seamlessly Expand Your Fintech Operations in the Philippines

Tap a deep, English‑proficient fintech talent market—without entity setup, payroll or regulatory headaches. KMC builds integrated teams that operate as an extension of your AU organisation.

Specialized Fintech Talent

Mid-to-senior professionals skilled in AML, KYC, blockchain development, digital banking security, and regulatory compliance.

Operational Control

Retain full visibility and control over your team, with scalable hiring models tailored to your growth.

Security & Compliance Expertise

Ensure compliance with AML, KYC, PCI-DSS, and ISO 27001 regulations.

Secure Fintech Workspaces

1.2M+ sq. ft. of fintech-ready office space, designed to support secure and regulated financial operations.

The Biggest Challenges Facing Fintech Companies Today

Specialised Fintech Talent

Mid‑to‑senior pros across AML/KYC, payments, blockchain, risk analytics and cyber—within a ~1.8M IT‑BPM workforce.

Operational Control

Your tools, your roadmaps and full visibility—plus flexible models that scale with demand.

Security & Compliance Expertise

Mapped to AUSTRAC AML/CTF, KYC, PCI‑DSS and ISO/IEC 27001—with documented procedures.

Secure Fintech Workspaces

1.2M+ sq ft of secure, access‑controlled offices engineered for regulated operations.

Build a Scalable Fintech Team with KMC Solutions

KMC delivers fintech‑ready professionals across engineering, risk, compliance and operations—combining regulatory fluency, secure delivery and on‑the‑ground support.

Top‑Tier Fintech Talent

Experienced specialists in payments, risk and regulatory domains.

Faster Team Expansion

Shortlists in days; onboarding in weeks, not months—without compliance gaps.

Cost‑Efficient Scaling

Reduce total hiring costs by up to 70% while maintaining quality and security.

Trusted by Industry Leaders

Global fintechs rely on KMC for fully managed, high‑performance teams.

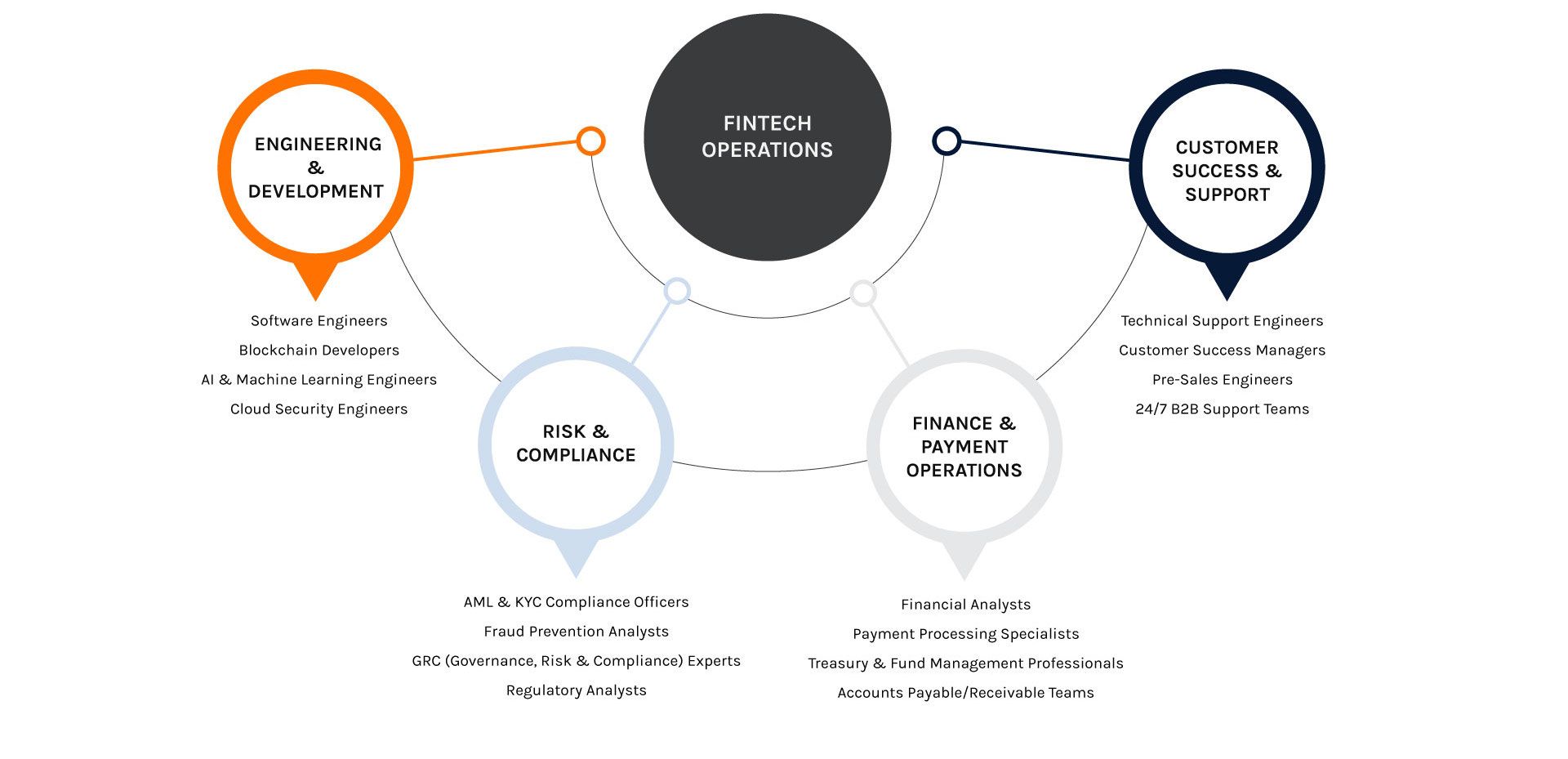

What Fintech Roles Can You Hire in the Philippines?

KMC fields specialists across financial technology, risk & compliance, finance ops and customer roles—supporting secure transactions and resilient growth.

Fintech Engineering & Product Development

- Software Engineers – secure apps for digital banking and payments

- Blockchain Developers – wallets, DeFi rails and crypto integrations

- AI/ML Experts – predictive fraud, risk models and automation

- Cloud Security Engineers – hardened fintech cloud environments

Risk & Compliance

- AML & KYC Officers – CDD/EDD, sanctions and ongoing monitoring

- Fraud Prevention Analysts – real‑time detection and investigation

- GRC Specialists – frameworks, controls and audit readiness

Finance & Operations

- Financial Analysts & Controllers – forecasting, reporting and FP&A

- Payment Processing Specialists – secure payment flows and settlement

- Treasury & Fund Management – liquidity, hedging and optimisation

Customer Success & Support

- Technical Support Engineers – product onboarding and L2/3 support

- Customer Success Managers – adoption, expansion and renewals

- 24/7 B2B Support Teams – enterprise‑grade coverage access fintech - specific talent and the support teams that keep you running

Building a Global Fintech Team with KMC Solutions

From engineering and cyber to risk, finance and CX—we assemble integrated teams aligned with your controls, SLAs and growth model.

Why Fintech Companies Like Unifi Books Trust KMC Solutions

Fast, Risk-Free Expansion

Hire without entity setup or regulatory exposure—move from plan to live quickly.

Full-Service HR & Compliance

We manage HR, payroll and local compliance, so you stay focused on delivery.

Secure, Compliant Infrastructure

ISO/IEC 27001 governance and PCI‑aware operations for regulated environments.

Scalable Growth Solutions

Flexible models for pilot, scale and BOT when you’re ready to own the entity.

Stories of Growth: How UniFi Books Scaled Its Financial Services Team with KMC Solutions

The Challenge: Expand financial operations while controlling cost and compliance risk.

- Tight US talent markets and rising costs

- Need for finance + compliance capacity, fast

- Requirement for secure, audited operations

The Solution: A fully integrated fintech team with KMC

- Established Ortigas HQ with Clark satellite for talent reach

- 10+ hires in three weeks across finance and compliance

- Aligned to AML, KYC, PCI‑DSS and ISO/IEC 27001

- Scaled from 30 → 100+ professionals in under six months

Now, UniFi operates a high‑performing, compliant fintech team—without entity setup or regulatory burden.

See What Some of Our 400+ Clients Say

Scale Your Fintech Operations with KMC Solutions

Secure elite fintech professionals, ensure compliance and scale seamlessly—while reducing costs.

Let’s build your world-class fintech team today.